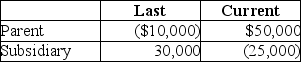

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year,the group files a consolidated tax return.The results for last year and the current year are: Taxable Income How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Gender Differences

Variations in characteristics, behaviors, and roles typically associated with being male or female.

Caregivers

Individuals who provide care for another person, typically a family member or someone with a chronic illness, disability, or other long-lasting health or care need.

Symbolic Play

A form of play in which children use objects, actions, or ideas to represent other objects, actions, or ideas, as a way of practicing and learning about their world.

Constructive Play

A type of play that involves creating or constructing something, typically allowing children to develop cognitive skills, problem-solving abilities, and hand-eye coordination.

Q3: At which funding round does the business

Q8: Allen contributed land,which was being held for

Q15: When using the Bardahl formula,an increase in

Q16: If a corporation's charitable contributions exceed the

Q32: In the current year,Pearl Corporation has $300,000

Q45: Mountaineer,Inc.has the following results: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1259/.jpg" alt="Mountaineer,Inc.has

Q54: Why are stock dividends generally nontaxable? Under

Q60: What are the tax consequences to Parent

Q70: What must be reported to the IRS

Q79: Florida Corporation is 100% owned by Lawton