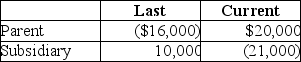

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year the group files a consolidated return. Taxable Income How much of the Subsidiary loss can be carried back to last year?

How much of the Subsidiary loss can be carried back to last year?

Definitions:

Oxygen Deprivation

A condition resulting from insufficient oxygen reaching the body's tissues and organs, leading to potential harm or dysfunction.

Central Nervous System

The part of the nervous system that consists of the brain and the spinal cord, crucial for processing and transmitting information.

Conglomerate Mergers

The combination or acquisition of companies operating in unrelated business activities, diversifying business interests and reducing risk.

Horizontal Mergers

A business strategy where companies operating in the same industry or producing similar products merge their operations.

Q3: Identify which of the following statements is

Q8: How many exchange-traded funds were listed at

Q26: Contingent immunisation is an example of strategies.<br><br>A)

Q34: Henriksson and Merton (1981)measure market timing using

Q40: In a study by Easton and

Q41: Identify which of the following statements is

Q57: A Canadian subsidiary cannot file as part

Q67: Identify which of the following statements is

Q84: The accumulated earnings tax is imposed at

Q98: Identify which of the following statements is