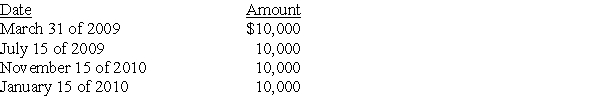

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Bulk Pricing

A strategy where goods are sold at a reduced price per unit when purchased in large quantities, encouraging larger purchases by consumers or businesses.

Children's Meals

Specially designed and portioned meals for children, often featuring nutritional considerations and appealing presentations.

Demand Curve

A graph showing the relationship between the quantity of a good consumers are willing to buy and its price.

Marginal Cost

The cost incurred by producing one additional unit of the product.

Q3: A partnership must file Form 1065 only

Q11: Identify which of the following statements is

Q31: Poppy Corporation was formed three years ago.Poppy's

Q32: Gee Corporation purchased land from an unrelated

Q75: Identify which of the following statements is

Q77: Zoe Ann transfers machinery having a $36,000

Q78: Identify which of the following statements is

Q81: Family Corporation,a corporation controlled by Buddy's family,redeems

Q90: For purposes of determining current E&P,which of

Q108: Perch Corporation has made paint and paint