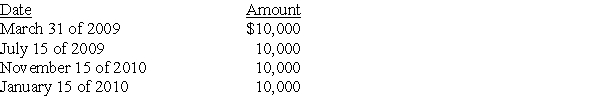

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Comparative Advantage

The capacity of a being to generate a product or service at a reduced opportunity cost compared to others.

Range Of Prices

A spectrum or interval between the lowest and highest prices at which goods or services are sold in the market.

Cups Of Soup

A measure of quantity often used in food service to represent single servings of soup.

Trade

Trade involves the exchange of goods, services, or both, between parties, which can be within an economy (domestic trade) or between economies (international trade).

Q8: How many exchange-traded funds were listed at

Q9: Elijah owns 20% of Park Corporation's single

Q13: Parent Corporation purchases all of Target Corporation's

Q33: Which of the following statements is incorrect

Q34: Identify which of the following statements is

Q48: A plan of liquidation must be reduced

Q59: Continental Corporation anticipates a 34% tax rate

Q63: Toby made a capital contribution of a

Q89: Baxter Corporation transfers assets with an adjusted

Q112: Walter,who owns all of the Ajax Corporation