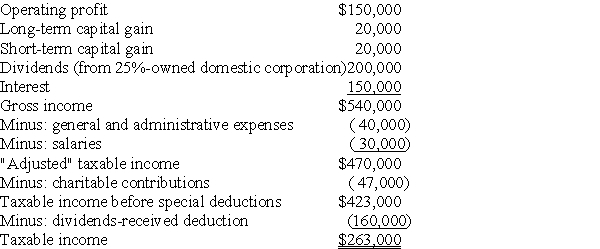

Mullins Corporation is classified as a PHC for the current year,reporting $263,000 of taxable income on its federal income tax return:

Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Actual charitable contributions made by Mullins Corporation were $75,000.What are the federal income tax due and the personal holding company (PHC)tax liability? Discuss the methods (if any)by which payment of the PHC tax can be avoided.

Definitions:

Sexual Response Cycle

A series of emotional and physical phases that individuals typically experience during sexual activity, including phases of arousal, plateau, orgasm, and resolution.

Excitement

A state or condition of heightened emotional arousal, enthusiasm, or eagerness.

Sociocultural Cause

Factors related to social and cultural conditions that can influence an individual's thoughts, behaviors, and emotions.

Low Sexual Desire

A reduced interest in sexual activity, which can be influenced by psychological, physiological, or relationship factors.

Q6: Which one of the following is not

Q11: Zeta Corporation received a $150,000 dividend from

Q29: On January 1,Alpha Corporation purchases 100% of

Q31: All of the following are recognized as

Q33: A foreign corporation with a single class

Q36: Upon formation of a corporation,its assets have

Q46: What are the four principles underlying ASC

Q68: Sarah purchased land for investment in 2008

Q86: Julia,an accrual-method taxpayer,is a U.S.citizen and a

Q91: When computing the accumulated earnings tax,which of