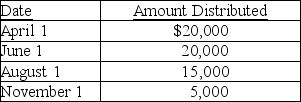

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Income Percentage

The portion or share of one's income allocated or spent on specific expenses, savings, or investments, usually expressed as a percentage.

Doctorate Degree

The highest level of academic degree awarded by universities, typically after a course of study that follows a master's degree.

Associate's Degree

A post-secondary degree awarded by community colleges, junior colleges, technical colleges, and some four-year institutions, typically requiring two years of study.

Master's Degree

An advanced academic degree granted by universities or colleges, typically requiring the completion of a bachelor's degree and involving focused study in a specific field or discipline.

Q5: Identify which of the following statements is

Q11: The IRS will issue a 90-day letter

Q12: Johnson Co.transferred part of its assets to

Q24: Nicholas,a 40% partner in Nedeau Partnership,gives one-half

Q29: In Fall 1999,Ford Motor Company's board of

Q41: Which of the following statements is not

Q53: The 90-day letter (Statutory Notice of Deficiency)gives

Q55: Green Corporation is incorporated on March 1

Q56: Ryan Corporation sells a commercial building and

Q63: Toby made a capital contribution of a