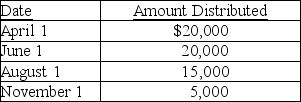

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Elastic Demand

The case in which the price elasticity of demand is greater than 1.

Excise Tax

A tax levied on specific goods, services, or transactions, often with the aim of discouraging their use or raising revenue.

Elastic Supply

A scenario where the quantity supplied of a good or service changes significantly in response to changes in its price.

Deadweight Loss

A loss of economic efficiency that occurs when equilibrium for a good or a service is not achieved, leading to a misallocation of resources.

Q3: Khuns Corporation,a personal holding company,reports the following:<br>

Q17: Will,a shareholder in Wiley Corporation,lent money to

Q24: The Alto-Baxter affiliated group filed a consolidated

Q26: John owns 70% of the May Corporation

Q43: Jack Corporation is owned 75% by Sherri

Q44: Pedro,a nonresident alien,licenses a patent to a

Q49: Once a corporation has elected a taxable

Q69: Why are other intercompany transactions not given

Q104: Henry transfers property with an adjusted basis

Q120: Organizational expenditures include all of the following