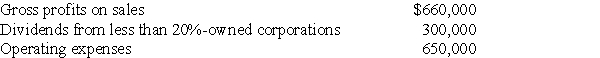

Carter Corporation reports the following results for the current year:

a)What is Carter Corporation's taxable income for the current year?

a)What is Carter Corporation's taxable income for the current year?

b)How would your answer to Part (a)change if Carter's operating expenses are instead $700,000?

c)How would your answer to Part (a)change if Carter's operating expenses are instead $760,000?

Definitions:

Plymouth Colony

An early settlement established in 1620 by English Puritans in present-day Massachusetts, known for the celebrated Thanksgiving feast.

Mayflower Compact

An agreement reached by the Pilgrims on the Mayflower in 1620, establishing self-governance in Plymouth Colony.

Civil Government

The branch of government concerned with the administration of the state, including the implementation and enforcement of laws and the management of public affairs.

Literacy

The ability to read and write, often considered a fundamental skill for accessing education and participating fully in society.

Q2: A subsidiary recognizes no gain or loss

Q3: Income in respect of a decedent (IRD)is

Q9: A deferred tax asset indicates that a

Q28: All of the taxable income of a

Q54: Darlene,a U.S.citizen,has foreign-earned income of $150,000 and

Q65: Martha owns Gator Corporation stock having an

Q74: Identify which of the following statements is

Q85: Identify which of the following statements is

Q106: When computing E&P,Section 179 property must be

Q115: Trail Corporation has gross profits on sales