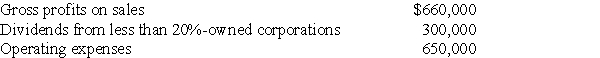

Carter Corporation reports the following results for the current year:

a)What is Carter Corporation's taxable income for the current year?

a)What is Carter Corporation's taxable income for the current year?

b)How would your answer to Part (a)change if Carter's operating expenses are instead $700,000?

c)How would your answer to Part (a)change if Carter's operating expenses are instead $760,000?

Definitions:

Ending Direct Materials

Ending Direct Materials refers to the value of raw materials that are still available for use in production at the end of an accounting period.

Required Production

Required production is the quantity of goods a company needs to produce in a given period to meet customer demand and maintain inventory levels.

Direct Labor

Labor costs directly associated with the manufacture of products or provision of services, such as wages for assembly line workers.

Manufacturing Overhead

Manufacturing overhead includes all indirect costs associated with the production process, such as utilities, maintenance, and salaries of non-direct labor employees.

Q10: Identify which of the following statements is

Q13: Parent Corporation purchases all of Target Corporation's

Q28: Marcella,an alien individual,is present in the United

Q40: Identify which of the following statements is

Q47: Key Corporation distributes a patent with an

Q49: Generally,a corporation recognizes a gain,but not a

Q58: Liquidating expenses are generally deducted as ordinary

Q70: Carolyn transfers property with an adjusted basis

Q80: Parent Corporation owns 80% of the stock

Q96: ASC 740 requires that<br>A) the AMT is