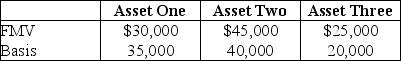

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec.351.  Max's recognized gain is

Max's recognized gain is

Definitions:

Span Of Control

The number of subordinates directly reporting to a manager.

Subordinates

Employees or team members who are under the direction and control of a senior manager or supervisor in an organizational hierarchy.

Manager

A person responsible for controlling or administering an organization or group of staff, focusing on achieving goals through directing efforts and resources.

Chain Of Command

The formal line of authority, communication, and responsibility within an organization.

Q7: The $3,000 limitation on deducting net capital

Q23: A sole proprietor is required to use

Q42: Discuss the IRS reporting requirements under Sec.351.

Q47: Discuss the transferor provisions relating to the

Q71: Green Corporation is a calendar-year taxpayer.All of

Q79: At Mark's death,Mark owed a debt of

Q86: Paul's tax liability for last year was

Q90: There are no tax consequences of a

Q93: Identify which of the following statements is

Q107: Brent,who died on January 10,owned 10 shares