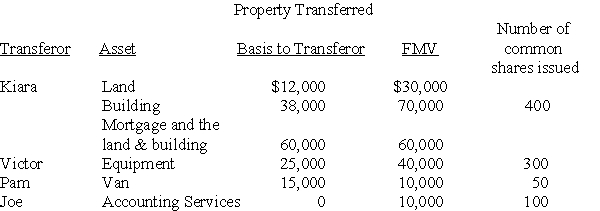

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Net Income

The amount of earnings left after all expenses, including taxes and costs, have been subtracted from total revenue.

Fixed Overhead

Fixed overhead consists of the consistent, ongoing costs not directly tied to production levels within a business, such as rent, insurance, and salaries.

Inventory

Items held by a company for sale in the ordinary course of business or to be used in producing goods and services for sale.

Absorption Costing

A methodology for product costing that comprehensively adds up the costs of direct materials, direct labor, and both fixed and variable manufacturing overheads.

Q18: Joyce passed away on January 3 while

Q20: Frans and Arie own 75 shares and

Q46: One of your corporate clients has recently

Q55: A trust reports the following results:<br> <img

Q59: Corporations cannot use the installment method in

Q64: Raptor Corporation is a PHC for 2009

Q65: The FMV of an asset for gift

Q73: Santa Fe Corporation adopts a plan of

Q78: Splash Corporation has $50,000 of taxable income

Q79: The statute of limitations,which stipulates the time