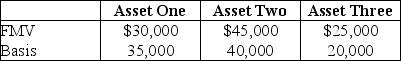

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec.351.  Max's recognized gain is

Max's recognized gain is

Definitions:

Revenue Enhancement

Strategies or actions taken to increase the amount of income generated from business operations.

Merger

A strategic corporate action where two or more entities combine their operations to form a new organization or become part of an existing one.

Tender Offer Takeovers

An acquisition strategy where the bidder offers to purchase shares from shareholders directly at a specified price, typically at a premium over the market price.

Gains

The financial increase obtained from an investment or transaction, exceeding the initial cost or investment.

Q13: Gene purchased land five years ago as

Q18: Joyce passed away on January 3 while

Q25: Joe dies late in 2011 and his

Q48: Dan transfers an apartment building to Grace

Q65: Parent Corporation for ten years has owned

Q66: Which of the following statements about the

Q72: Quality Corporation created a foreign subsidiary in

Q82: According to Circular 230,what should a CPA

Q82: Charitable contributions made by a fiduciary<br>A) are

Q92: Bruce receives 20 stock rights in a