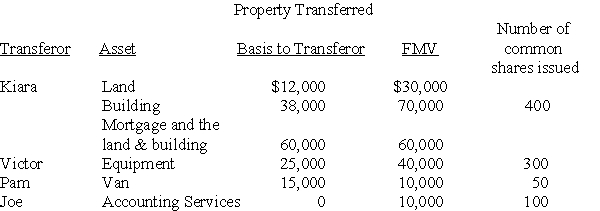

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Liability

Any financial obligation or debt that an entity is responsible for paying to another party.

Current Asset

An asset expected to be converted into cash, sold, or consumed within one year or within the business's normal operating cycle if longer.

Treasury Stock

Shares that were issued and subsequently repurchased by the company, reducing the amount of outstanding stock on the open market.

Total Assets

The combined value of all assets, including cash, inventory, property, and equipment, owned by a person or business.

Q14: Vanda Corporation sold a truck with an

Q15: How does the IRS regulate the activities

Q16: A trust has net accounting income of

Q19: Bell Corporation,a domestic corporation,sells jars to its

Q21: On July 9,2008,Tom purchased a computer (five-year

Q31: The estate tax return is due,ignoring extensions,3-1/2

Q37: A partial liquidation of a corporation is

Q74: Henry transfers property with an adjusted basis

Q97: Little Corporation uses the accrual method of

Q105: Ray died on March 4.His estate includes