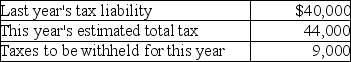

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits.Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty.Assume your client's adjusted gross income last year was $140,000.

Definitions:

High Market Share

A situation where a company or product has a higher percentage of total sales revenue of a market compared to its competitors.

Low-Growth Market

A market characterized by slow increases in demand or sales over time.

Heavy Resource Investments

The allocation of a significant amount of organizational resources, such as time, money, and effort, into a project or initiative.

Question Marks

Strategic business units characterized by uncertain futures due to their position in fast-growing markets with low relative market share, necessitating careful analysis for future investment.

Q7: The annual exclusion permits donors to make

Q14: Identify which of the following statements is

Q14: Joan transfers land (a capital asset)having a

Q24: In 1997,Barry and Fred provide $20,000 and

Q31: Baxter Corporation is a personal service corporation.Baxter

Q36: Which of the following circumstances would cause

Q50: The IRS audits Kiara's current-year individual return

Q89: Good Times Corporation has a $60,000 accumulated

Q90: U.S.citizens and resident aliens working abroad may

Q105: Identify which of the following statements is