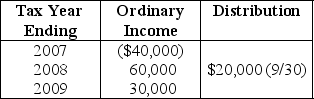

Robert Elk paid $100,000 for all of the single class of stock of Elkom Corporation,an electing S corporation,when incorporated in January,2007.Elkom's operating results and dividend distribution are as follows:

What is Elk's basis for his Elkom stock on December 31 of 2007?

What is Elk's basis for his Elkom stock on December 31 of 2007?

Definitions:

Total Assets

The sum of all resources owned by an entity that are recognized as having economic value.

Net Income

The total profit of a business after all expenses and taxes have been deducted from total revenue.

Internal Growth Rate

The maximum rate at which a company can expand using only its own sources of funding without resorting to external financial options.

Constant Percentage

A fixed percentage rate applied to various mathematical and financial calculations.

Q35: Even if the termination of an S

Q50: Identify which of the following statements is

Q53: A partnership terminates for tax purposes<br>A) only

Q53: Which of the following deposit requirements pertains

Q56: Bellows Corporation,a calendar-year taxpayer,has been an S

Q59: On December 31,Kate receives a $28,000 liquidating

Q60: The statute of limitations is unlimited for

Q62: Two years ago,Tom contributed investment land with

Q67: Explain one of the two exceptions to

Q105: Yellow Trust must distribute 33% of its