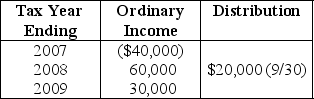

Robert Elk paid $100,000 for all of the single class of stock of Elkom Corporation,an electing S corporation,when incorporated in January,2007.Elkom's operating results and dividend distribution are as follows:

What is Elk's basis for his Elkom stock on December 31 of 2007?

What is Elk's basis for his Elkom stock on December 31 of 2007?

Definitions:

Ionizing Power

The ability of a chemical element or electromagnetic radiation to ionize atoms or molecules by altering their charge through the removal or addition of electrons.

Beta Particles

High-energy, high-speed electrons or positrons emitted by certain types of radioactive nuclei during radioactive decay.

Beta Emission

A type of radioactive decay where a beta particle (an electron or positron) is emitted from an atomic nucleus.

Gamma Radiation

High-energy electromagnetic radiation emitted from atomic nuclei during radioactive decay, with no mass and no charge.

Q6: A letter ruling is a written determination

Q9: In list form,outline the steps to follow

Q10: Christmas gifts,excluding noncash gifts of nominal value,are

Q30: John has a basis in his partnership

Q39: Employers do not pay payroll taxes on

Q47: Even if the duties of depositing the

Q60: Which of the following statements is incorrect?<br>A)

Q85: In a current distribution,the partner's basis in

Q99: Roger makes a $1,000,000 cash gift on

Q107: The Principle Limited Partnership has more than