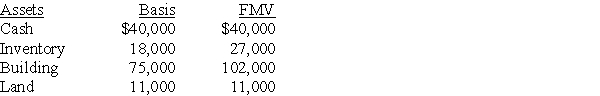

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000.On the date of sale,the partnership has no liabilities and the following assets:

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

Definitions:

In-group

A social group toward which an individual feels loyalty and respect, often distinguishing members from those in the out-group.

More Responsibility

Refers to an increase in the duties or tasks assigned to an individual, typically implying greater accountability.

Leader

A person who influences a group towards achieving a common goal.

Psychometric Properties

Refers to the attributes such as reliability and validity that evaluate the quality of psychological tests or measurements.

Q3: The Senate equivalent of the House Ways

Q31: The AB Partnership has a machine with

Q31: In order to obtain the maximum credit

Q46: One of your corporate clients has recently

Q48: Training sessions are counted as working time

Q55: Gift tax returns are filed on a

Q67: All states have adopted laws providing for

Q73: Mirabelle contributed land with a $5,000 basis

Q75: Power Corporation reports the following results:<br> <img

Q81: Marge died on August 24 of the