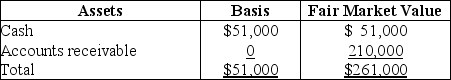

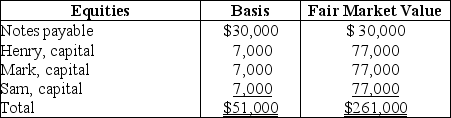

The HMS Partnership,a cash method of accounting entity,has the following balance sheet at December 31 of last year:

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Sam,who has a one-third interest in profits,losses,and liabilities,sells his partnership interest to Beverly,for $77,000 cash on January 1 of this year.Sam's basis in his partnership interest (which,of course,includes a share of partnership liabilities)at the time of the sale was $17,000.In addition,Beverly assumes Sam's share of the partnership liabilities.What is the amount and character of the gain that Sam will recognize from this sale?

Definitions:

Days' Sales Uncollected

A measure of how quickly a company converts its accounts receivable into cash, indicating the average number of days sales remain uncollected.

Financial Information

Data concerning the financial status or operations of an entity, including statements and transactions.

Acid-Test Ratio

A financial metric used to determine a company's short-term liquidity position by comparing its most liquid assets, excluding inventories, against its short-term liabilities.

Financial Information

Data related to the financial status of an entity, including balance sheets, profit and loss statements, and cash flow reports.

Q9: Under the Consumer Credit Protection Act,disposable earnings

Q12: Employers not subject to Title VII coverage

Q38: Anyone who prepares a tax return is

Q46: Refer to Instruction 5-1.Queno Company had FUTA

Q50: An employer will use the payroll register

Q55: Which of the following cannot be included

Q65: Danielle has a basis in her partnership

Q65: Those tasks that employees must perform and

Q82: Charitable contributions made by a fiduciary<br>A) are

Q88: Assume that you want to read a