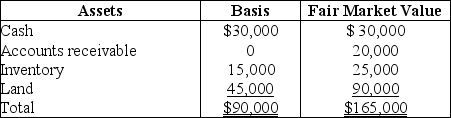

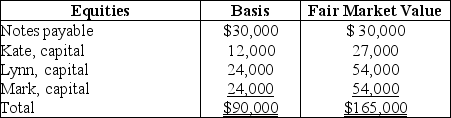

On December 31,Kate sells her 20% interest (with a basis of $18,000 which,of course,includes a share of partnership liabilities)in the KLM Partnership to Karl for $27,000 cash plus assumption of her $6,000 share of liabilities.On that date,the partnership has the following balance sheet:

What are the amount and character of the gain that Kate must recognize on the sale?

What are the amount and character of the gain that Kate must recognize on the sale?

Definitions:

drawOval

A method in the Java graphics class used to draw an oval shape based on specified dimensions and coordinates.

fillRect

In computer graphics, the "fillRect" method is used to draw and fill a rectangle with a specific color or pattern in a graphical user interface.

Java Applet

A Java applet was a small application written in Java, designed to be transmitted over the internet and executed by a web browser, though largely obsolete today.

Combo Box

A graphical user interface component that combines a drop-down box with the option for the user to type an entry.

Q2: An employer is required to submit a

Q11: On March 1,Bart transfers ownership of a

Q20: What is an electing large partnership? What

Q26: A Sec."2503(c)trust"<br>A) is a discretionary trust for

Q35: Under the FLSA,regular rate of pay does

Q38: Mary creates and funds a revocable trust.Mary

Q44: A trust has net accounting income and

Q69: A partner can recognize gain,but not loss,on

Q69: Chuck Corporation reports the following results for

Q74: The XYZ Partnership owns the following assets