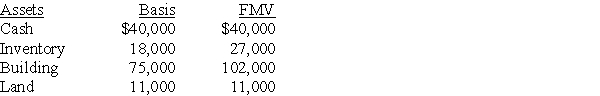

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000.On the date of sale,the partnership has no liabilities and the following assets:

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

Definitions:

Piaget's Concept

A theory in psychology that outlines how children's intellectual development progresses through distinct stages.

Another Person's Eyes

A metaphorical phrase encouraging empathy, suggesting to see or understand a situation from someone else's perspective.

Freudian Psychoanalysis

Freudian Psychoanalysis is a psychological theory and therapeutic method developed by Sigmund Freud, focusing on unconscious thought processes, early childhood experiences, and the role of sexual and aggressive instincts in human behavior.

Same-sex Parents

Individuals of the same sex who are raising children together, regardless of whether they are biological parents, adoptive parents, or caregivers in a different capacity.

Q13: Panther Trust has net accounting income and

Q27: For FUTA purposes,an employer can be any

Q29: An S corporation is permitted to claim<br>A)

Q44: What is the character of the gain/loss

Q45: All of the following are properly defined

Q47: Administration expenses incurred by an estate<br>A) are

Q60: An employer can use a credit card

Q68: Identify which of the following statements is

Q74: The XYZ Partnership owns the following assets

Q89: Estates and trusts<br>A) are taxed on state