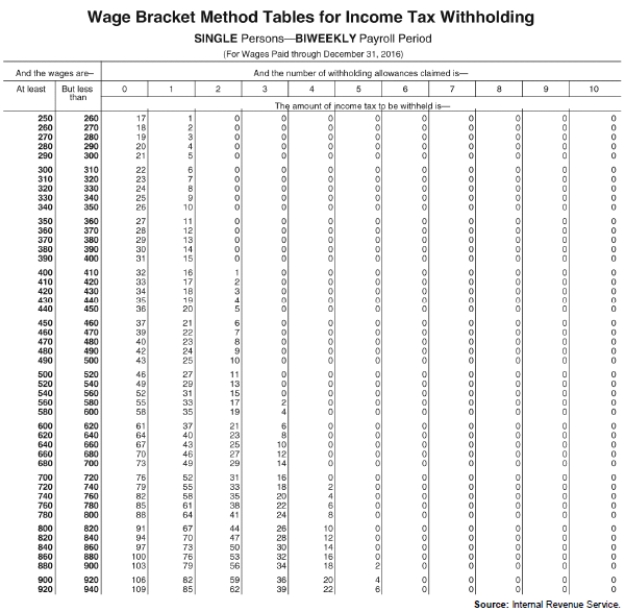

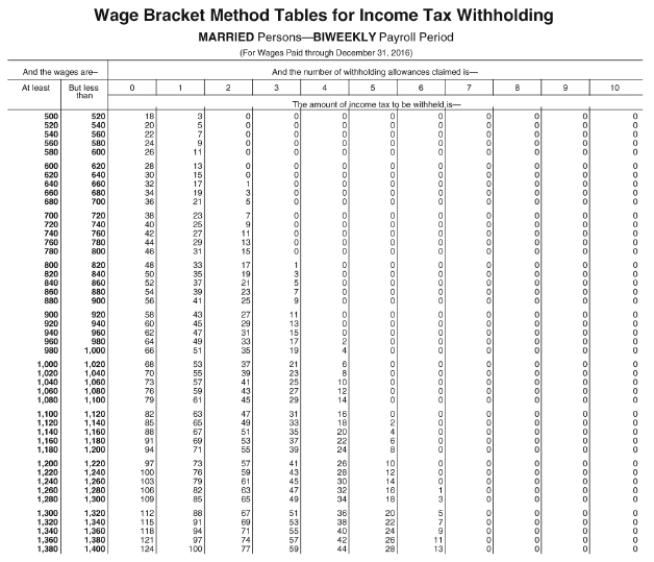

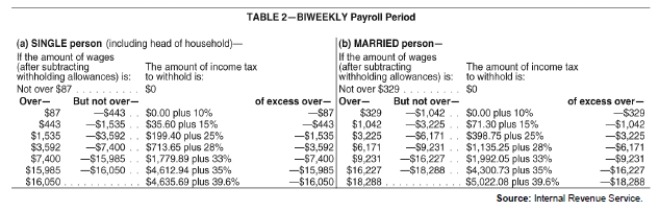

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

-Refer to Exhibit 4-1.Determine the income tax to withhold from the biweekly wages of the following employees (wage-bracket):

Karen Overton (single,0 allowances),$900 wages

__________________

Nancy Haller (married,4 allowances),$1,000 wages

__________________

Alan Glasgow (married,1 allowance),$980 wages

__________________

Joseph Kerr (single,4 allowances),$720 wages

__________________

Ginni Lorenz (single,1 allowance),$580 wages

__________________

Definitions:

Menstrual Cycle

The monthly series of changes a woman's body goes through in preparation for the possibility of pregnancy.

Estrogen

A collection of steroid hormones responsible for stimulating and preserving female traits in humans.

ATP

Adenosine triphosphate, a molecule that stores and transfers energy within cells.

Endometrium

The mucous membrane lining the inside of the uterus, which thickens during the menstrual cycle in preparation for potential pregnancy.

Q4: Exit price accounting has been criticised for

Q17: A price-protected owner will remunerate their manager

Q19: The FASB,the US standard setter,unlike the IASB,distinguished

Q22: Which of these accounts shows the total

Q23: Sean,Penelope,and Juan formed the SPJ partnership by

Q32: 'The empirical research provides evidence of benefits

Q43: For purposes of Sec.751,inventory includes all of

Q69: A partner can recognize gain,but not loss,on

Q77: Refer to Instruction 2-1.Kevin Kurtz is a

Q88: Assume that you want to read a