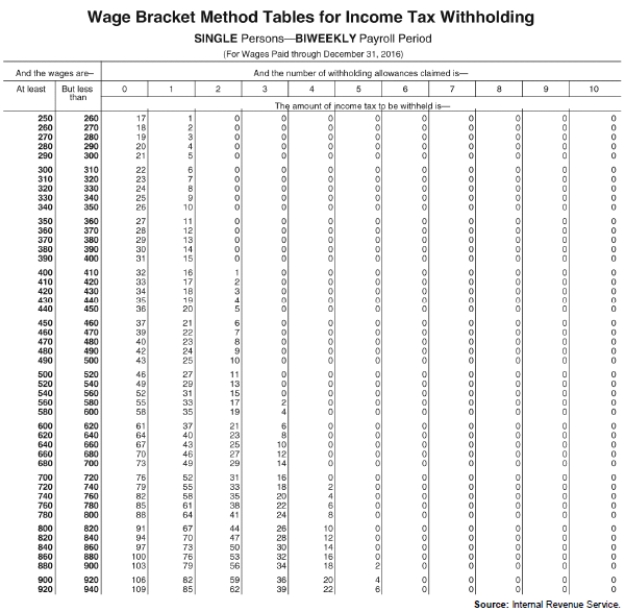

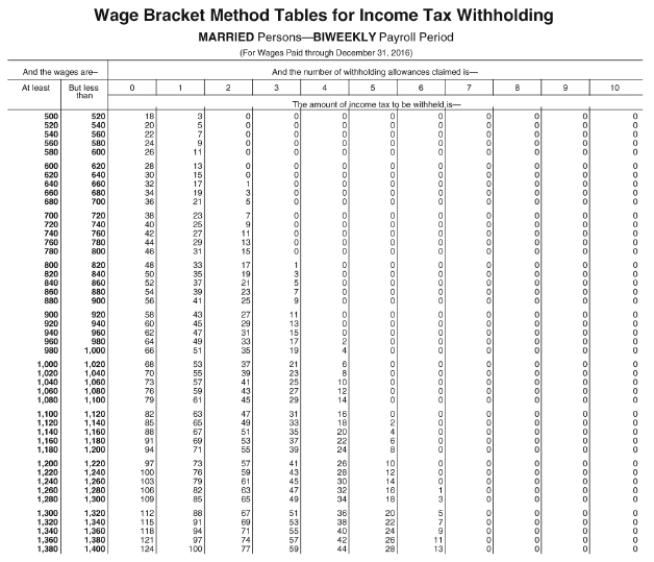

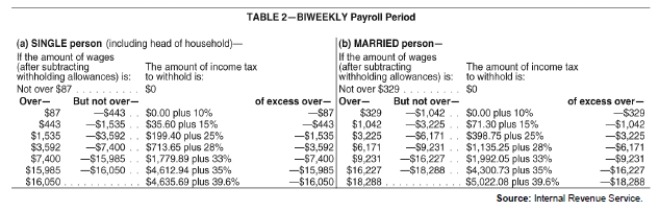

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

-Refer to Exhibit 4-1.Calculate the amount to withhold from the following employees using the biweekly table of the percentage method.

Kenneth Karcher (single,1 allowance = $155.80),$895 wages

__________

Mary Kenny (married,2 allowances = $311.60),$1,900 wages

__________

Thomas Carney (single,0 allowances),$1,460 wages

__________

Definitions:

Cost of Debt

is the effective rate that a company pays on its total debt, an important component in calculating the cost of capital.

Security Market Line

A graphical representation of the risk-return trade-off for individual securities, illustrating the capital asset pricing model (CAPM).

Risk-free Rate

The yield from an investment that carries no risk of losing money.

Expected Return

Return on a risky asset expected in the future.

Q1: Monthly depositors are required to deposit their

Q13: Discuss the limitations of behavioural accounting research.

Q27: Explain and comment on the behavioural view

Q30: If revenue for 2010 is understated then:<br>A)Profit

Q50: Which of the following forms is used

Q65: Danielle has a basis in her partnership

Q65: Which of the following is secondary authority?<br>A)

Q69: When a taxpayer contacts a tax advisor

Q84: According to the Statements on Standards for

Q98: Identify which of the following statements is