Instruction 3-1

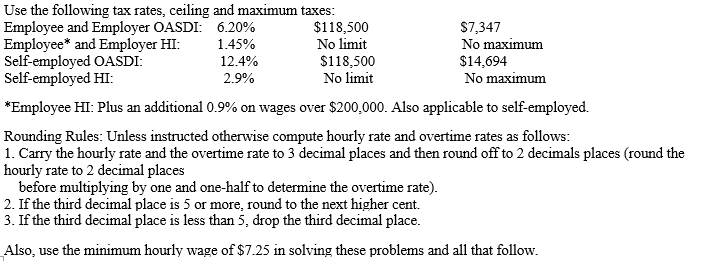

-Refer to Instruction 3-1.On the last weekly pay of the first quarter,Lorenz is paid her current pay of $90 per day for four days worked and one day sick pay (total-$450).She is also paid her first quarter commission of $1,200 in this pay.How much will be deducted for:

a)OASDI tax __________

b)HI tax __________

Definitions:

Short Run

A period during which at least one factor of production is fixed and cannot be changed, influencing a firm's capacity to alter production levels.

Marginal Cost

The expense associated with manufacturing an additional unit of a product or service.

Perfectly Competitive Firm

A business operating in a market where it has no power to influence the price of its product; it is a price taker.

Marginal Cost

The financial outlay for producing a further unit of a product or service.

Q2: The FASB and IASB have concluded that

Q10: Refer to Exhibit 6-1.Journalize the adjustment for

Q11: Which measurement was agreed as the best

Q17: Refer to Instruction 2-1.Carla Maloney is a

Q24: Social accounting and reporting aims at observing

Q30: Refer to Instruction 5-1.Faruga Company had FUTA

Q30: John has a basis in his partnership

Q37: When the federal tax deposit is made,the

Q45: Which of the following is not true

Q77: Identify which of the following statements is