Instruction 3-1 -Refer to Instruction 3-1.Eager,a Tipped Employee,reported to His Employer That

Instruction 3-1

-Refer to Instruction 3-1.Eager,a tipped employee,reported to his employer that he had received $320 in tips during March.On the next payday,April 1,he was paid his regular salary of $400.

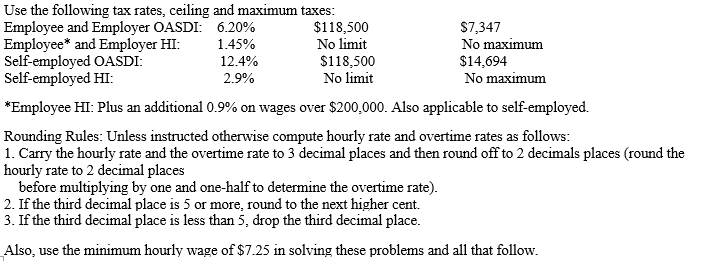

a)The amount of OASDI taxes to withhold from Eager's pay is __________.

b)The amount of HI taxes to withhold from Eager's pay is __________.

Definitions:

Vouchers Payable

Liabilities representing invoices that have been received but not yet paid.

Separation Of Duties

Separation of duties is a key control in internal systems, aimed at reducing the risk of fraud and errors by ensuring that no single individual has control over all aspects of a financial transaction.

Approves Purchases

Refers to the process or authority given to certain individuals or systems to validate and authorize the acquisition of goods or services for a business or organization.

Journal Entries

The basic record-keeping of a company's financial transactions, recorded in the chronological order.

Q11: Are preference shares debt or equity and

Q11: Which measurement was agreed as the best

Q16: Under the FASB's Concept Statement No 6,the

Q22: Insurance agents paid solely on a commission

Q25: One of the limitations of using CART

Q26: Identify which of the following statements is

Q29: In January 2017,the minimum hourly wage was:<br>A)

Q86: The definition of "unrealized receivable" does not

Q89: What are the advantages of a firm

Q100: The AB,BC,and CD Partnerships merge into the