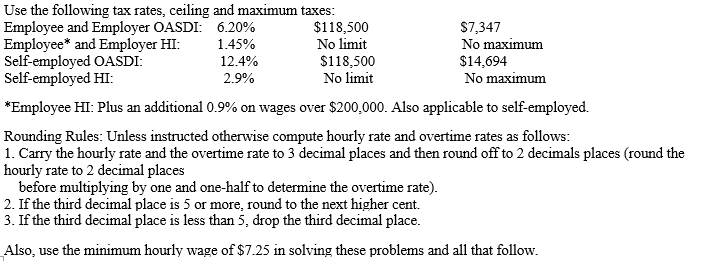

Instruction 3-1

-Refer to Instruction 3-1.Dee is paid $1,345 on November 8,20--.Dee had cumulative gross earnings,including overtime pay,of $117,200 prior to this pay.

a)The amount of OASDI taxes to withhold from Dee's pay is __________.

b)The amount of HI taxes to withhold from Dee's pay is __________.

Definitions:

Q11: An example of attribute unclear error is:<br>A)An

Q23: Which of these is not an issue

Q23: The statement that is not true in

Q35: Employers can exempt the following from the

Q50: Which of the following forms is used

Q52: Which of the following is not allowed

Q61: OASDI taxes are levied when the wages

Q81: Explain the difference between a closed-fact and

Q94: The ABC Partnership owns the following assets

Q103: Identify which of the following statements is