Instruction 3-1 -Refer to Instruction 3-1.Eager,a Tipped Employee,reported to His Employer That

Instruction 3-1

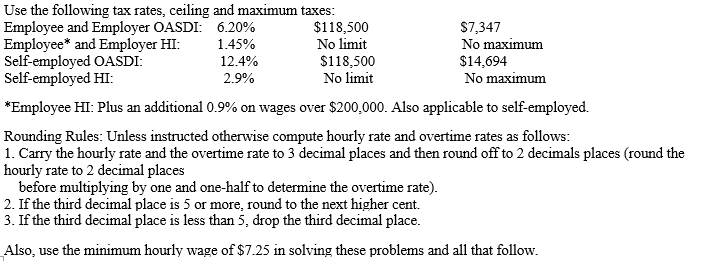

-Refer to Instruction 3-1.Eager,a tipped employee,reported to his employer that he had received $320 in tips during March.On the next payday,April 1,he was paid his regular salary of $400.

a)The amount of OASDI taxes to withhold from Eager's pay is __________.

b)The amount of HI taxes to withhold from Eager's pay is __________.

Definitions:

Cost-Plus Approach

A pricing strategy where a fixed percentage or amount is added to the cost of producing a product or service to determine its selling price.

Normal Levels

Typical or expected conditions or ranges within which processes or operations are considered to be functioning optimally.

Product Cost Concept

An accounting principle that includes all costs related to the creation of a product, including raw materials, labor, and overhead expenses.

Manufacturing Costs

Expenses related to the production of goods, including labor, materials, and overhead.

Q7: Treating expenses as assets:<br>A)Overstates profit and understates

Q10: Under the Family and Medical Leave Act,employers

Q16: Under the FASB's Concept Statement No 6,the

Q24: The term 'posterior odds' in Bayes' theorem

Q27: It is usually considered that IFRS standards

Q27: A valuation approach used by current IASB

Q32: The Tax Court decides an expenditure is

Q36: The rule of thumb that refers to

Q68: When a retiring partner receives payments that

Q90: If a partnership chooses to form an