Instruction 3-1

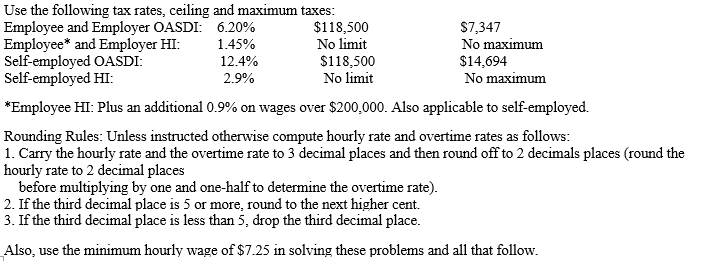

-Refer to Instruction 3-1.Fess receives wages totaling $74,500 and has net earnings from self-employment amounting to $51,300.In determining her taxable self-employment income for the OASDI tax,how much of her net self-employment earnings must Fess count?

Definitions:

Nominal Rate

The stated interest rate of a bond or loan, not adjusted for inflation.

Compounded Annually

A method in which interest is calculated once per year and added to the total sum, affecting the principal for the next period.

Promissory Note

A promissory note is a financial instrument that contains a written promise by one party to pay another party a determinate sum of money either on demand or at a specified future date.

Compounded Semi-Annually

The method of calculating interest on a principal where the interest is computed twice a year and each interest payment is added to the principal for future calculations.

Q3: Are holding gains a component of accounting

Q3: Which of these is not an accepted

Q7: The hypothesis that assumes that the capital

Q12: Generally speaking accountants are more likely to

Q14: An S corporation is not treated as

Q19: Each accounting measurement model creates the same

Q39: Under the Uniform Unclaimed Property Act,any unclaimed

Q54: In computing their own FICA taxes,employers may

Q63: The Wage and Hour Division allows the

Q70: Zebra Corporation has always been an S