Instruction 3-1 -Refer to Instruction 3-1.On August 1,Huff (Part-Time Waitress)reported on Form

Instruction 3-1

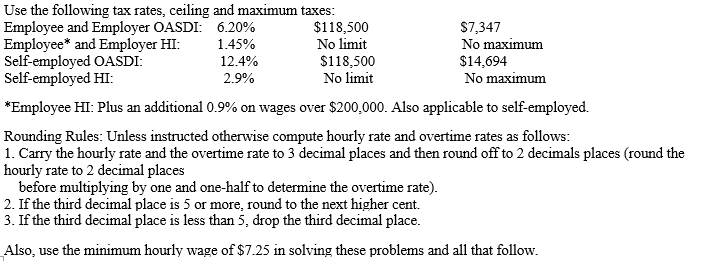

-Refer to Instruction 3-1.On August 1,Huff (part-time waitress)reported on Form 4070 the cash tips of $158.50 that she received in July.During August,Huff was paid wages of $550 by her employer.Determine:

OASDI

HI

a)The amount of social security taxes that the employer should withhold from Huff's wages during August:

__________

__________

b)The amount of the employer's social security taxes on Huff's wages and tips during August:

__________

__________

Definitions:

Alcohol Dependent

A condition characterized by a physical and psychological reliance on alcohol, leading to significant impairment or distress.

Project MATCH

A landmark study in addiction research that aimed to match individuals with alcoholism to the treatment approach most appropriate for them.

Alcohol Dependency

A medical condition characterized by a persistent and strong desire to drink alcohol and difficulties controlling its use despite adverse consequences.

Cognitive-Behavioral Intervention

A psycho-social intervention that aims to improve mental health by focusing on changing negative thoughts and behaviors.

Q19: Which of these research findings is not

Q20: The taxpayer need not pay the disputed

Q37: Each of the following items is accurately

Q41: Identify which of the following statements is

Q53: Violators of the overtime provision of the

Q55: Which of the following payments are taxable

Q56: The withholding of federal income and FICA

Q67: In order for the Walsh-Healey Public Contracts

Q81: Explain the difference between a closed-fact and

Q101: Identify which of the following statements is