Instruction 3-1

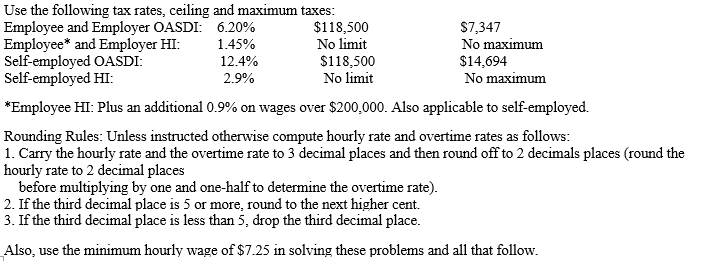

-Refer to Instruction 3-1.In this pay,Moss Company deducted OASDI taxes of $5,276.24 and HI taxes of $1,233.95 from the $85,100.90 of taxable wages paid.What is Moss Company's portion of the social security taxes for:

a)OASDI

b)HI

Definitions:

Retail Method

An accounting technique used to estimate inventory value by calculating a cost to retail price ratio and applying it to the ending inventory at retail prices.

Merchandise Inventory

The total value of a retailer's goods that are available for sale to customers.

Estimated Cost

A prediction or forecast of the future cost of a project, operation, or production based on current data and trends.

Gross Profit Rate

A financial metric that measures the difference between sales and the cost of goods sold, expressed as a percentage of sales.

Q13: All of the following are covered by

Q22: Where revenue is not recognised until cash

Q23: Which of these possible methods for settling

Q26: Arguments in favour of including 'exchangeability' as

Q30: FUTA was designed to ensure that workers

Q38: The alternative that is not an argument

Q45: Do most distributions made by a partnership

Q70: Payments made to a worker's spouse for

Q103: Your client wants to deduct commuting expenses

Q107: Statements on Standards for Tax Services are