Instruction 3-1 -Refer to Instruction 3-1.Jax Company's (A Monthly Depositor)tax Liability (Amount

Instruction 3-1

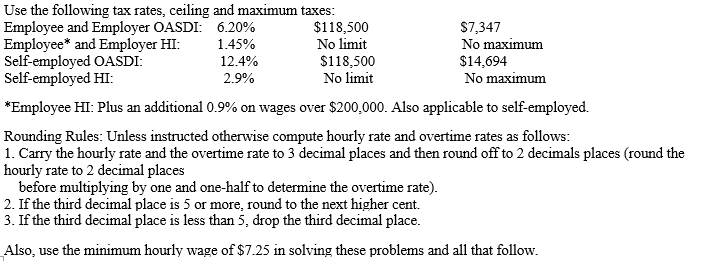

-Refer to Instruction 3-1.Jax Company's (a monthly depositor)tax liability (amount withheld from employees' wages for federal income tax and FICA tax plus the company's portion of the FICA tax)for July was $1,210.No deposit was made by the company until August 24,20--.Determine:

a)The date by which the deposit should have been made

b)The penalty for failure to make timely deposit

c)The penalty for failure to fully pay tax when due

d)The interest on taxes due and unpaid (assume a 3% interest rate)

Definitions:

Relationship Selling

A sales approach focusing on building long-term relationships with clients rather than focusing solely on individual transactions, emphasizing trust and mutual benefit.

Partnering/Consultative Selling

A sales approach that focuses on building a long-term relationship with the customer, where the seller acts more as an advisor than a traditional salesperson.

Follow Up

Follow-up refers to the actions taken to maintain contact and ensure satisfactory progress or resolution after an initial meeting, sale, or conversation.

Product Effectiveness

The degree to which a product successfully meets the intended purpose or satisfies customer needs and expectations.

Q18: The treatment of the relationship of losses

Q21: The Framework specifically states that the matching

Q27: Cactus Corporation,an S Corporation,had accumulated earnings and

Q33: The highest paid executives of a firm

Q34: The FASB shows its supports for the

Q39: An S corporation reports ordinary income of

Q41: The Social Security Act does not require

Q65: Which of the following is secondary authority?<br>A)

Q72: Refer to Instruction 2-1.Jose Cruz earns $2,275

Q89: What are the advantages of a firm