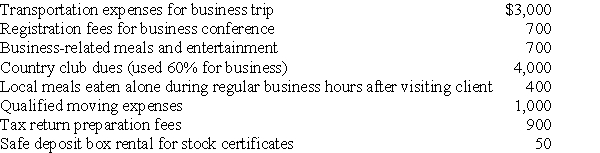

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Responsibility

The obligation to carry out duties, make decisions, and be accountable for the outcomes.

Product Design

The process of ideating, creating, and iterating products with the goal of solving users' problems or addressing specific needs.

Overhead Costs

Expenses incurred in the running of a business that are not directly tied to specific products or services, such as rent, utilities, and administrative salaries.

Functional Resources

Assets allocated to support specific functions or operations within a company, such as human resources, finance, or technology.

Q21: If parents claim a child as an

Q23: Compounding refers to the<br>A)mistake of confusing present

Q27: Sarah incurred employee business expenses of $5,000

Q38: Business investigation expenses incurred by a taxpayer

Q41: Martin Corporation granted a nonqualified stock option

Q57: Martha,an accrual-method taxpayer,has an accounting practice.In 2016,she

Q59: Property that has appreciated in value generally

Q66: Which item below is not a type

Q81: A theft loss is deducted in the

Q86: Generally,50% of the cost of business gifts