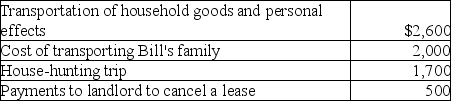

Bill obtained a new job in Boston.He incurred the following moving expenses:

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Definitions:

Total Utility

The total satisfaction or benefit received by consuming a particular amount of a good or service.

Income

Financial returns, mainly recurring, as compensation for work or investment income.

Technological Advance

The introduction of new technologies or the improvement of existing technologies, leading to better products, services, or ways of doing things.

Process Innovation

The introduction of new or significantly improved production or delivery methods, enhancing efficiency and effectiveness.

Q2: Which of the following statements is false?<br>A)IRS

Q3: Which item below contains all inflexible expenses?<br>A)Rent,dining

Q3: Clayton contributes land to the American Red

Q20: Sue Hank has just indicated that the

Q49: Liquid assets are less risky than investment

Q54: A Series EE bond is an example

Q63: Which of the following is an example

Q64: Generally,you can invest in higher-return assets for

Q112: For the years 2013 through 2017 (inclusive)

Q129: Josiah is a human resources manager of