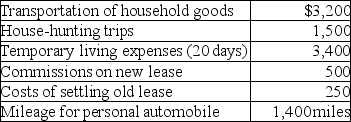

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Definitions:

Cash Receipts

Cash receipts are the total amount of money, including cash and checks, received by a business during a specific period for goods or services provided.

Q16: Highly volatile inflation rates and earning rates

Q18: Explain why interest expense on investments is

Q21: A net operating loss can be carried

Q35: Leonard owns a hotel which was damaged

Q60: In a defined contribution pension plan,fixed amounts

Q61: Monthly budget estimates for many line items

Q72: Which of the following would not be

Q92: The following is a correct order of

Q112: For the years 2013 through 2017 (inclusive)

Q117: A net operating loss (NOL) occurs when