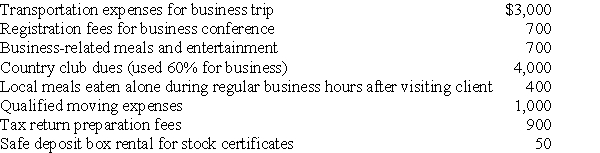

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

EBIT

Earnings Before Interest and Taxes, a measure of a company's profit that includes all incomes and expenses except interest and income tax expenses.

ROCE

Return on Capital Employed; a measure of a company's profitability in relation to its capital, indicating how efficiently capital is being utilized to generate profits.

After Tax Cost

The net cost of an investment or financing option after taking into account the effects of taxes.

Financial Leverage

Applying borrowed resources to escalate the potential profits of an investment.

Q23: Legal fees for drafting a will are

Q24: The vacation home limitations of Section 280A

Q49: Which of the following statements is incorrect

Q50: Desi Corporation incurs $5,000 in travel,market surveys,and

Q50: From the saver's point of view,the best

Q57: According to the IRS,a person's tax home

Q62: Jarrett owns a mountain chalet that he

Q62: Assuming positive interest rates,a present value of

Q105: Interest expense on debt incurred to purchase

Q112: Adjusted gross income equals gross income plus