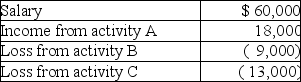

Nancy reports the following income and loss in the current year.

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

Definitions:

General Partners

Individuals in a partnership who have unlimited liability and are responsible for the management of the partnership.

Partnership Management

The practice of organizing and coordinating the operations and strategies of a business partnership.

Corporate Affairs

The activities, strategies, and management decisions related to the operation and governance of a corporation.

Director

An individual appointed or elected to sit on a corporate board, responsible for making significant business decisions and overseeing the company's affairs.

Q7: Taxpayers may elect to include net capital

Q9: Efrain owns 1,000 shares of RJ Inc.common

Q26: Characteristics of profit-sharing plans include all of

Q66: Which of the following statements is incorrect

Q75: What must a taxpayer do to properly

Q84: Kaitlyn owns a hotel in Phoenix,Arizona.The Arizona

Q96: Donald has retired from his job as

Q126: Which of the following is not required

Q126: Expenses related to a hobby are deductible

Q139: State and local government taxes vary considerably