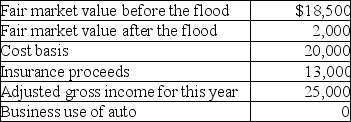

A flood damaged an auto owned by Mr.and Mrs.South on June 15 of this year.The car was only used for personal purposes.

Based on these facts,what is the amount of the South's casualty loss deduction after limitations for this year?

Definitions:

Customer Value

The perception of worth that a product or service has in the mind of the consumer, often influencing their buying decisions.

Internal Accounting Systems

The set of procedures and records that a company's management uses for financial planning, analysis, and decision making within the company.

Dysfunctional Results

Outcomes of processes or activities that negatively affect the goals or functioning of an organization.

External Failure Cost

Costs incurred when a defective product or service is discovered after delivery to the customer, including returns, repairs, and lost sales.

Q4: A sole proprietor will not be allowed

Q16: In determining whether travel expenses are deductible,a

Q18: Richard exchanges a building with a basis

Q30: Arun paid the following taxes this year:<br><img

Q53: Taj operates a sole proprietorship,maintaining the business

Q63: If an individual taxpayer's net long-term capital

Q95: Olivia,a single taxpayer,has AGI of $280,000 which

Q96: Shaunda has AGI of $90,000 and owns

Q129: Josiah is a human resources manager of

Q145: Distinguish between the Corn Products doctrine and