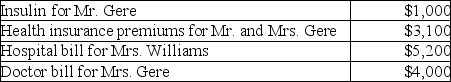

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.

Mr.and Mrs.Gere (both age 40) received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

IRR

Internal Rate of Return represents a financial measure for assessing the potential profitability of investments.

Marginal Cost

The cost added by producing one additional unit of a product or service.

Average Total Cost

Calculated as the total cost of production (fixed plus variable costs) divided by the total output, indicating the average cost per unit produced.

Q20: $500 invested at 8% at the beginning

Q39: At 12% interest (compounded annually),$20,000 invested today

Q48: Young people most likely prefer a savings

Q61: Personal travel expenses are deductible as miscellaneous

Q67: Sharif is planning to buy a new

Q82: Sam received a scholarship for room and

Q83: In 2015 Betty loaned her son,Juan,$10,000 to

Q93: What is or are the standards that

Q122: All realized gains and losses are recognized

Q133: Fees paid to prepare a taxpayer's Schedule