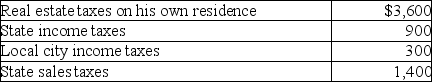

Matt paid the following taxes this year:

What is the maximum amount Matt can deduct as an itemized deduction on his tax return?

Definitions:

Property Taxes

Taxes levied by local governments based on the value of property, including land and buildings, owned by individuals or companies.

Attorney Fees

Payments made to lawyers for legal services rendered.

Graded

A term typically used in education to describe the evaluation of work or performance by assigning a level, score, or category.

Straight-Line Method

A depreciation method that allocates an equal portion of the initial cost of an asset to each accounting period over the asset's useful life.

Q9: Adam purchased stock in 2006 for $100,000.He

Q19: Transportation expenses incurred to travel from one

Q51: Jim Burt has decided to cut classes

Q61: List those criteria necessary for an expenditure

Q70: Mark and his brother,Rick,each own farms.Rick is

Q75: Material participation by a taxpayer in a

Q76: A single individual with no dependents can

Q103: Adam purchased 1,000 shares of Airco Inc.common

Q116: A taxpayer has generated a net operating

Q142: Losses are generally deductible if incurred in