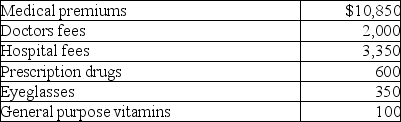

Mitzi's medical expenses include the following:

Mitzi's AGI for the year is $33,000.She is single and age 49.None of the medical costs are reimbursed by insurance.After considering the AGI floor,Mitzi's medical expense deduction is

Definitions:

Abatement

A reduction or decrease, often referred to in the context of taxes, rent, or legal penalties.

Bequests

Bequests are gifts of money or personal property left to a beneficiary through a will or estate plan.

Adequate

Sufficient to satisfy a requirement or meet a need.

Executor

A legal term referring to an individual appointed to carry out the terms of a will.

Q13: Which of the following is not required

Q25: An accountant takes her client to a

Q37: How is a claim for refund of

Q39: At 12% interest (compounded annually),$20,000 invested today

Q55: Investment interest expense is deductible<br>A) as an

Q60: Which one of the following fringe benefits

Q60: Tom and Shawn own all of the

Q61: Personal travel expenses are deductible as miscellaneous

Q105: Interest expense on debt incurred to purchase

Q123: What is required for an individual to