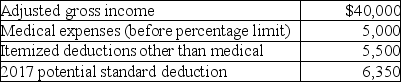

A review of the 2017 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2017 tax status:

In 2018,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

Definitions:

General Duty

An obligation or requirement that one must adhere to in a specific role or context, often implying a standard level of care or responsibility.

Causation

The relationship between an action and its effect, where the action is considered to be a contributing factor to the outcome or injury.

Negligence

The failure to exercise the standard of care that a reasonably prudent person would have exercised in a similar situation, leading to harm or damage.

Res Ipsa Loquitur

A legal principle that infers negligence from the very nature of an accident or injury, in the absence of direct evidence on how any defendant behaved.

Q6: The text discusses the topic of compounding

Q25: In a recession,college recruiting is often curtailed

Q29: Dividends on life insurance policies are generally

Q34: Candice owns a mutual fund that reinvests

Q40: Under a qualified pension plan,the employer's deduction

Q66: According to the tax formula,individuals can deduct

Q80: Avantra Inc.is a professional firm with the

Q84: "Associated with" entertainment expenditures generally must occur

Q94: Christopher,a cash-basis taxpayer,borrows $1,000 from ABC Bank

Q105: The cumulative variable is equal to<br>A)favorable variances