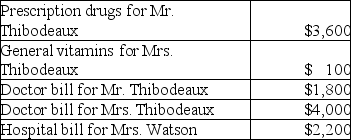

Mr.and Mrs.Thibodeaux (both age 35) ,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Factory Overhead

All indirect costs associated with manufacturing a product, including the costs of running the factory but excluding direct materials and direct labor.

Journalize

The process of recording transactions in a company's journal as part of the accounting cycle.

April

The month that comes fourth in the Gregorian calendar year.

Factory Overhead

All indirect costs, including indirect materials, labor, and expenses, incurred during the manufacturing process.

Q16: For the years 2013 through 2017 (inclusive)

Q18: The future value of a $500 ordinary

Q28: Explain how tax planning may allow a

Q34: For a bad debt to be deductible,the

Q39: Foreign real property taxes and foreign income

Q40: Abra Corporation generated $100,000 of taxable income

Q57: According to the IRS,a person's tax home

Q85: Ellie,a CPA,incurred the following deductible education expenses

Q112: Most U.S.families save less than 6% of

Q126: Which of the following is not required