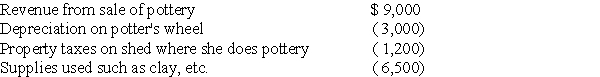

Lindsey Forbes,a detective who is single,operates a small pottery activity on a part-time basis.This year she reported the following income and expenses from this activity:

In addition,she had salary of $70,000 and itemized deductions,not including expenses listed above,of $6,800.

a. What is the amount of Lindsey's taxable income assuming the activity is classified as a hobby?

b. What is the amount of Lindsey's taxable income assuming the activity is classified as a trade or business?

Definitions:

Traffic Problems

Issues related to the congestion and management of vehicles on roadways, affecting travel time and safety.

Decibels

A unit of measurement used to express the intensity of sound, symbolized as dB.

Human Ear

A part of the human body that is responsible for detecting sound and helping in the balance and positioning of the body.

Artificial Light

Light produced by electrical means, as opposed to natural light sourced from the sun.

Q16: For the years 2013 through 2017 (inclusive)

Q25: When are points paid on a loan

Q29: Under the wash sale rule,if all of

Q31: Premiums paid by an employer for employee

Q64: If an activity produces a profit for

Q84: Expenditures which do not add to the

Q99: A taxpayer can deduct a reasonable amount

Q105: Hope receives an $18,500 scholarship from State

Q107: Expenses incurred in a trade or business

Q111: Toni owns a gourmet dog treat shop