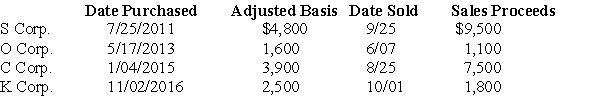

Mike sold the following shares of stock in 2017:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a) 33% and (b) 39.6%? Ignore the medicare tax on net investment income.

Definitions:

Specialized Role

A position that requires a specific set of skills or knowledge, often associated with a particular field or function.

Leadership

The ability to guide, direct, or influence people toward achieving a common goal.

Ethical Use

The responsible utilization of resources or power in a manner that considers moral principles.

Power

The capacity or ability of an individual or group to influence the behavior of others or the course of events.

Q49: During the current year,Don's aunt Natalie gave

Q52: If a taxpayer makes a charitable contribution

Q52: Natasha,age 58,purchases an annuity for $40,000.Natasha will

Q57: This year,Jason sold some qualified small business

Q74: Leo spent $6,600 to construct an entrance

Q77: Carol contributes a painting to a local

Q85: If a taxpayer's method of accounting does

Q101: Arthur,age 99,holds some stock purchased many years

Q102: A taxpayer incurs a net operating loss

Q138: The requirements for a payment to be