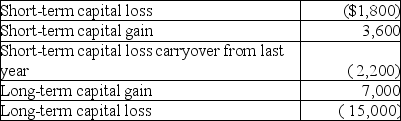

During the current year,Nancy had the following transactions:

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

Definitions:

Congenital Blindness

Blindness that occurs from birth due to genetic factors, abnormalities in the fetal development process, or birth trauma.

Hemiplegia

A condition resulting in paralysis on one side of the body, often due to a stroke or brain injury.

Ambulation

The ability to walk from place to place independently with or without an assistive device.

Diabetic Retinopathy

A complication of diabetes that affects the eyes, characterized by damage to the blood vessels of the retina.

Q12: No deduction is allowed for a partially

Q14: Rich,an individual investor,lives in a land of

Q37: Property settlements made incident to a divorce

Q57: Martha,an accrual-method taxpayer,has an accounting practice.In 2016,she

Q63: If an individual taxpayer's net long-term capital

Q76: Thomas purchased an annuity for $20,000 that

Q98: Rachel has significant travel and entertainment expenses

Q102: Corporate charitable deductions are limited to 10%

Q107: Harley,a single individual,provided you with the following

Q120: A taxpayer has low AGI this year,but