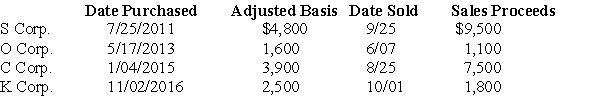

Mike sold the following shares of stock in 2017:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a) 33% and (b) 39.6%? Ignore the medicare tax on net investment income.

Definitions:

Service Cost

The portion of the expense of a pension plan that is attributed to the increase in pension benefits due to employee service in the current period.

Interest Cost

The cost incurred by an entity for borrowing funds, typically calculated as the interest rate times the principal amount of the debt.

Return On Plan Assets

The rate of return earned on the investments of a pension plan or other retirement fund over a specified period.

Discount Rate

The interest rate used to determine the present value of future cash flows in discounted cash flow analysis.

Q14: Jillian has just accepted an offer from

Q15: All of the following are true of

Q35: Tax returns from individual taxpayers and partnerships

Q37: A married taxpayer may file as head

Q42: Punitive damages are taxable unless they are

Q88: Expenditures for a weight reduction program are

Q89: Three years ago,Myriah refinanced her home mortgage

Q113: To qualify as an abandoned spouse,the taxpayer

Q115: Nate sold two securities in 2017:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1260/.jpg"

Q143: Kelsey enjoys making cupcakes as a hobby