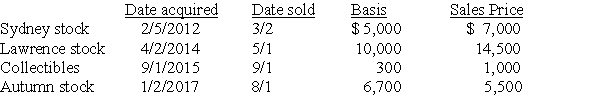

Chen had the following capital asset transactions during 2017:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Definitions:

Pollution Permits

Allowances provided by government regulations that permit companies to emit a certain level of pollutants.

Global Warming

The long-term increase in Earth's average surface temperature, primarily due to human activities such as fossil fuel burning.

Invisible Hand

A term coined by economist Adam Smith to describe the self-regulating nature of the marketplace where individuals' pursuit of self-interest leads to societal benefits.

Capital Owners

Individuals or entities that own assets with economic value expected to benefit future operations, such as machinery, buildings, or equipment.

Q2: On January 1 of this year,Brad purchased

Q3: Jana reports the following income and loss:<br><img

Q27: Social Security benefits are excluded from taxation

Q30: Arun paid the following taxes this year:<br><img

Q36: In the case of foreign-earned income,U.S.citizens may

Q71: Mr.and Mrs.Gere,who are filing a joint return,have

Q77: Ellen is a single taxpayer with qualified

Q101: Victor,a calendar-year taxpayer,owns 100 shares of AB

Q117: Daniel plans to invest $20,000 in either

Q121: For each of the following independent cases,indicate