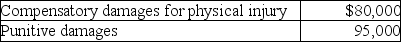

Derrick was in an automobile accident while he was going to work.The doctor advised him to stay home for eight months due to his physical injuries.The resulting lawsuit was settled and Derrick received the following amounts:

How much of the settlement must Derrick include in ordinary income on his tax return?

Definitions:

Desirable Rewards

Incentives or benefits that motivate individuals to engage in certain behaviors by appealing to their wants, needs, or aspirations.

George Homans

An American sociologist known for his work in social behavior as exchange, contributing significantly to the development of behavioral sociology.

Rational Action

Decision-making behaviors that are consistent with logic and reason, aimed at achieving personal objectives or goals.

Weak Power Networks

Networks characterized by limited influence, resources, or connections among its members.

Q1: Avi and Rianna are considering marriage before

Q15: Carl purchased a machine for use in

Q39: Foreign real property taxes and foreign income

Q39: A single taxpayer has adjusted gross income

Q53: Gains and losses are recognized when property

Q59: Payments received from a workers' compensation plan

Q64: Taxpayers may not deduct interest expense on

Q76: Tonya's employer pays the full premium on

Q79: On July 25,2016,Karen gives stock with a

Q107: Julia,age 57,purchases an annuity for $33,600.Julia will