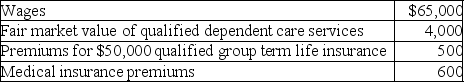

Carl filed his tax return,properly claiming the head of household filing status.Carl's employer paid or provided the following to Carl:

How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

Definitions:

Accounting Profits

Accounting profits refer to the net earnings of a company as calculated by subtracting total expenses from total revenues, using standard accounting principles.

Economic Profits

The difference between total revenues and total costs, including both explicit and implicit costs, indicating the profitability of a company beyond basic accounting measures.

Economic Losses

Financial losses that occur when the cost of production exceeds the revenue generated from sales.

Total Output

The total quantity of goods or services produced by a firm or economy in a given period.

Q1: Five different capital gain tax rates could

Q5: The taxable portion of a gain from

Q31: How long must a capital asset be

Q32: Antonio is single and has taxable income

Q34: Super Development Company purchased land in the

Q56: Benedict serves in the U.S.Congress.In the current

Q68: David's father is retired and receives $14,000

Q132: Taxpayers may deduct lobbying expenses incurred to

Q132: In 2017,Phuong transferred land having a $150,000

Q139: Section 1221 specifically states that inventory or