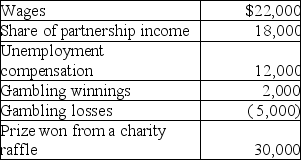

Lori had the following income and losses during the current year:

What is Lori's adjusted gross income?

Definitions:

Variable Cost

Costs that change in proportion to the level of production or business activity. This includes costs like raw materials and direct labor.

Unit Contribution Margin

The difference between the selling price per unit and the variable cost per unit, indicating how much each unit sold contributes towards fixed costs and profit.

Break-Even Analysis

An analytical process to determine at what point a business neither makes a profit nor incurs a loss, calculated by equating total costs with total revenues.

Production Supervisor

A production supervisor is responsible for overseeing the daily operations of manufacturing plants, ensuring that production schedules are met and quality standards are maintained.

Q17: Lloyd purchased 100 shares of Gold Corporation

Q20: Section 1221 of the Code includes a

Q23: A single taxpayer earns a salary of

Q23: How does an electing large partnership differ

Q30: Josh purchases a personal residence for $278,000

Q74: Nondiscrimination requirements do not apply to working

Q85: An unmarried taxpayer may file as head

Q109: An LLC that elects to be taxed

Q141: If an individual with a marginal tax

Q142: Income from illegal activities is taxable.