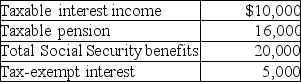

Mr.& Mrs.Tsayong are both over 66 years of age and are filing a joint return.Their income this year consisted of the following:

They did not have any adjustments to income.What amount of Mr.& Mrs.Tsayongs Social Security benefits is taxable this year?

Definitions:

Franchises

A type of license that grants a franchisee access to a franchisor’s proprietary business knowledge, processes, and trademarks, thus allowing the franchisee to sell a product or service under the franchisor's business model.

Plant Assets

Long-term tangible assets that are used in the production or supply of goods and services, such as machinery, buildings, and vehicles.

Natural Resources

Assets that occur in nature, like minerals, timber, and oil, which can be used for economic benefit.

Intangible Assets

Non-physical assets owned by a business that have value, such as patents, trademarks, goodwill, and copyrights.

Q16: The investment models discussed in the text

Q21: Eva is the sole shareholder of an

Q54: Louisiana Land Corporation reported the following results

Q71: To be tax deductible by an accrual-basis

Q73: Adjusted net capital gain is taxed at

Q83: Stephanie owns a 25% interest in a

Q110: Jing,who is single,paid educational expenses of $16,000

Q119: Taxpayers have the choice of claiming either

Q141: If an individual with a marginal tax

Q142: Losses are generally deductible if incurred in